BTC Price Prediction: Analyzing Trends and Forecasts Through 2040

#BTC

- Critical Technical Support: Bitcoin is testing key support near the lower Bollinger Band (~$82,232). Holding above this level is crucial to prevent a deeper correction towards $78,000.

- Institutional Demand vs. Market Fear: While price drops cause liquidations and nervousness, aggressive buying by entities like MicroStrategy indicates strong institutional conviction that may stabilize the market.

- Long-Term Bullish Drivers Remain Intact: Forecasts for 2030 and beyond are anchored in Bitcoin's fixed supply, increasing adoption as a treasury asset, and its potential role in the future digital economy, despite near-term volatility.

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture Below Key Moving Averages

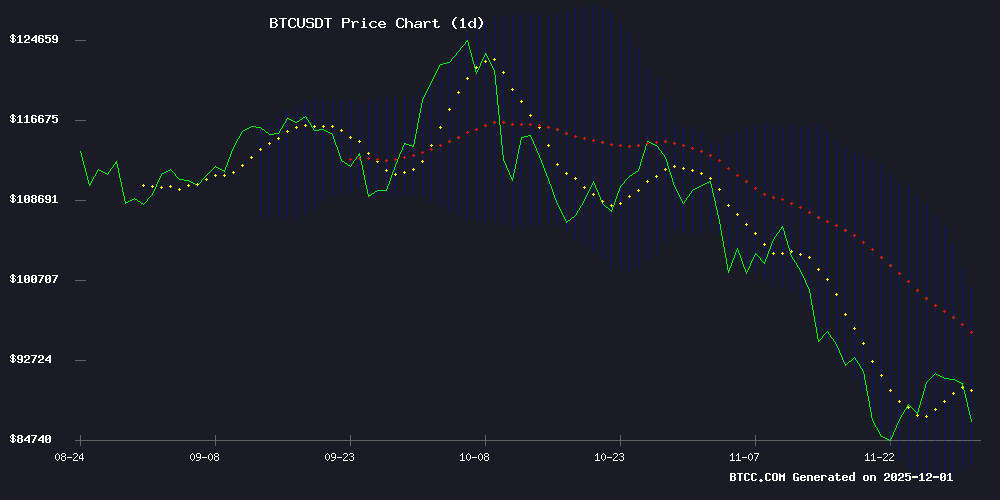

As of December 1, 2025, Bitcoin is trading at, positioned below its 20-day moving average of 91,088.25. This places the price near the lower Bollinger Band (82,232.23), suggesting the asset is testing a significant support zone. The MACD indicator, with a value of -1,594.92, confirms a bearish short-term momentum as the signal line remains above the MACD line.

"The breach below the 20-day MA is a cautionary signal," says BTCC financial analyst Mia. "However, the proximity to the lower Bollinger Band often precedes a period of consolidation or a potential rebound, as the asset becomes technically oversold. The key will be whether support at the $82,000-$83,000 level holds."

Market Sentiment: Volatility and Institutional Conviction Collide

Current headlines paint a picture of market tension. Sharp price drops to the $86,000 level have triggered significant liquidations, fostering nervousness. Yet, this is counterbalanced by bold institutional moves, most notably MicroStrategy's substantial additional purchase and the establishment of a $1.44 billion bitcoin reserve.

"The news flow encapsulates the current dichotomy," observes BTCC's Mia. "While retail and Leveraged traders feel the squeeze from volatility, major corporate players are demonstrating strategic conviction, viewing dips as accumulation opportunities. Sentiment is mixed but leans toward a 'buy the fear' narrative among long-term holders, supported by voices like Elon Musk discussing Bitcoin's resilience."

Factors Influencing BTC’s Price

MicroStrategy Doubles Down on Bitcoin with $1.44B Reserve Amid Market Volatility

Michael Saylor's MicroStrategy has made a bold move in the cryptocurrency market, purchasing an additional 130 BTC despite Bitcoin's price dropping below $90,000. This acquisition brings the company's total Bitcoin holdings to a staggering 650,000 BTC, valued at approximately $1.44 billion.

The strategic accumulation comes as many traders retreat from the market. MicroStrategy's latest move demonstrates unwavering confidence in Bitcoin's long-term value proposition, establishing a substantial reserve position during a period of market uncertainty.

Strategy Expands Bitcoin Holdings and Creates $1.44B Reserve

Strategy has bolstered its Bitcoin portfolio with the purchase of 130 BTC for approximately $11.7 million, averaging $89,960 per coin. This acquisition elevates its total holdings to 650,000 BTC, with an average cost basis of $74,436 per Bitcoin—representing a total investment of $48.38 billion.

In a parallel move, the firm established a $1.44 billion USD reserve, funded through stock sales, to safeguard preferred dividends and interest payments. This financial cushion is designed to mitigate volatility risks, underscoring institutional confidence in Bitcoin's long-term value proposition.

Bitcoin Nervousness Spurs Unprecedented Moves: Company Dives into Strategy BTC Purchase

Bitcoin closed November with dramatic volatility, briefly dipping to $84,756 amid market panic. Against this backdrop, Strategy announced a significant acquisition—adding 130 BTC at an average price of $89,960, totaling $11.7 million. The firm now holds 650,000 BTC, a staggering position given Bitcoin’s capped supply of 21 million.

Concerns about liquidity and dividend payments surfaced as the company’s MNAV approached 1. Yet Strategy revealed a $1.44 billion USD reserve earmarked for dividends, accumulated without selling any Bitcoin. This move not only stabilizes its financial footing but could also reignite investor confidence. A recovering MNAV may pave the way for renewed debt issuance and aggressive BTC accumulation, echoing its earlier growth trajectory.

Ex-Citi Analyst Challenges Hayes' Tether Stability Concerns

Former Citi crypto research lead Joseph has publicly countered BitMEX co-founder Arthur Hayes' warnings about Tether's financial health. The debate, unfolding on X, centers on whether the stablecoin issuer's $30 billion equity cushion and Treasury holdings adequately protect it against interest rate risks.

Tether CEO Paolo Ardoino dismissed insolvency concerns as "FUD," pointing to the company's substantial corporate equity and steady income from Treasury investments. Hayes had argued that potential Fed rate cuts could erode Tether's interest income, while volatility in its Bitcoin and gold positions might threaten its equity buffer.

The exchange highlights ongoing tensions between crypto innovators and traditional finance analysts in assessing stablecoin reserves. Tether's transparency practices remain under scrutiny as its USDT token continues to dominate the $140 billion stablecoin market.

MicroStrategy Faces Pressure as Bitcoin Strategy Draws Scrutiny

MicroStrategy Inc. (MSTR) closed at $177.18 amid growing institutional skepticism about its Bitcoin-heavy strategy. The company transferred 58,390 BTC to Fidelity Custody—a $5 billion repositioning that underscores its all-in bet on cryptocurrency. JPMorgan analysts warn of potential delisting risks from major indices, citing regulatory and market volatility concerns.

Despite short-term headwinds, MicroStrategy’s multi-year returns remain formidable. The firm now holds 649,870 BTC ($58 billion), making it the world’s largest corporate Bitcoin treasury. Recent on-chain movements reveal aggressive portfolio management, with billions shifted between Coinbase and institutional custodians.

Institutional investors trimmed MSTR positions in Q3 2025, reflecting broader crypto-sector caution. Yet the stock’s 0.88% gain on Black Friday suggests lingering bullish sentiment among retail traders. Market watchers await Michael Saylor’s next move as Bitcoin’s price action continues to dictate MicroStrategy’s valuation.

Bitcoin Slides to $85K as Asian Stocks Shake Global Markets

Bitcoin tumbled from $91,000 to $85,000 amid Asian market volatility and central bank actions, defying supportive macroeconomic trends. The Bank of Japan's hawkish stance and weak Chinese data amplified selling pressure, though institutional accumulation provided a floor.

Whale activity and miner restraint countered ETF outflows as BTC stabilized near $86,500. Global liquidity shifts and bond market moves drove the selloff, with traders eyeing December rate cut odds now at 85%.

Divergent Fed commentary reflects persistent inflation concerns despite softening labor data, creating crosscurrents for risk assets. The crypto dip mirrors broader market uncertainty rather than blockchain-specific developments.

Bitcoin Tests Key Support After Sharp Drop to $86,000

Bitcoin's price tumbled from $90,000 to $86,000 in a liquidity-driven sell-off as monthly algorithmic resets triggered stop-loss cascades. The move lacked fundamental catalysts but exposed fragile market structure during thin trading conditions.

Analysts now watch the $86,000 level as a litmus test for near-term direction. A failure to reclaim this threshold risks further downside toward the $83,000-$85,000 support zone, where clustered stop orders could amplify volatility.

Michaël van de Poppe notes the pullback fits within Bitcoin's broader consolidation phase. The coming weeks may see another attempt at the $100,000 psychological barrier if buyers defend current ranges.

Crypto Crash Today: Bitcoin Price Drops to $86K as $637M Liquidations Hit the Market

Bitcoin plunged 6.5% to $86,000 in a violent 24-hour selloff, dragging the broader crypto market down with $637 million in liquidations. The move mirrored global risk-asset turbulence after the Bank of Japan signaled potential rate hikes, threatening the yen carry trade that has fueled speculative investments for years.

Algorithmic trading exacerbated the decline as new month/quarter rebalancing triggered automated selling. Capital flows reversed sharply, with Japanese investors repatriating funds amid rising domestic bond yields. This liquidity drain hit crypto particularly hard given its reliance on speculative margin positions.

How Low Can Bitcoin Price Go?

Bitcoin enters December under significant pressure, having plummeted 18% in November—its worst performance for the month since 2018. The sharp decline has left traders questioning whether the bottom is in or if further downside looms.

Crypto analyst CrypNuevo highlights a critical resistance level at $80K, suggesting Bitcoin must breach this barrier to initiate a sustained rally. Currently trading near $86,743, BTC remains below the 1-week 50 EMA, a key indicator of market sentiment. Historically, prolonged stays below this level have preceded retests of lower supports.

The price action mirrors February–March 2024’s pattern: a liquidation-driven drop, swift rebound, rejection at the daily 50 EMA, and eventual breakout to new highs. For bullish momentum to resurge, Bitcoin must reclaim $99K, with interim hurdles at $94.5K.

ARK Invest Rebalances Portfolio: Divests GitLab for Bitcoin ETF Exposure

Cathie Wood's ARK Invest executed another round of strategic portfolio adjustments, offloading $8.46 million worth of GitLab shares while expanding its Bitcoin ETF holdings. The November 28 trades mark a continuation of the firm's pivot toward crypto assets, following a $26.8 million GitLab sale just three days prior.

The investment manager acquired 70,125 shares of its ARK 21Shares Bitcoin ETF (BTC) alongside trimming positions in Iridium Communications and other tech holdings. These moves occurred across multiple ARK funds including the flagship Innovation ETF and Next Generation Internet ETF, signaling a coordinated shift in allocation strategy.

GitLab's DevOps platform appears to be facing reduced institutional support from its former champion. Meanwhile, the Bitcoin ETF purchases reinforce ARK's public bullish stance on cryptocurrency adoption, particularly through regulated investment vehicles.

Elon Musk Predicts Bitcoin's Resilience and the Future of Money in Conversation with Nikhil Kamath

Elon Musk, in a discussion with Zerodha co-founder Nikhil Kamath, emphasized Bitcoin's unique strength as a currency "based on energy" rather than government control. Musk argued that Bitcoin's foundation in energy makes it inherently resilient, contrasting it with traditional fiat systems.

The tech billionaire also speculated on the long-term future of money, suggesting that conventional currencies may become obsolete as AI and robotics create abundance. "Money disappears as a concept," Musk stated, envisioning a post-scarcity economy where labor incentives are unnecessary.

Musk drew parallels to Iain Banks' Culture series, hinting at how advanced societies might retain symbolic value systems even in resource-rich environments. The conversation touched on AI's role in shaping future economies, with Musk warning that artificial intelligence must prioritize "truth, beauty, and curiosity" to ensure humanity's safe evolution.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on the provided technical data and prevailing market dynamics, here is a forward-looking analysis for Bitcoin's price trajectory. These are model-based projections and should not be considered financial advice.

| Year | Price Forecast Range (USDT) | Analytical Rationale |

|---|---|---|

| 2025 | $78,000 - $95,000 | Current technical setup suggests a test of lower support (~$82K). Year-end price will depend on holding this level and reclaiming the 20-day MA. Institutional accumulation (e.g., MicroStrategy) may provide a floor. |

| 2030 | $180,000 - $350,000 | Assuming continued adoption, regulatory clarity, and integration as a digital reserve asset. Halving cycles and scaling solutions (e.g., Lightning Network) reaching maturity could drive this multi-fold increase. |

| 2035 | $500,000 - $1,000,000+ | Potential for Bitcoin to solidify its role as 'digital gold' in a fully digitized global economy. Network effects, scarcity (21M cap), and use as a sovereign and corporate treasury asset become primary drivers. |

| 2040 | Scenario Dependent | Long-term forecasts are highly speculative. Outcomes range from widespread global adoption as a base monetary layer to niche asset status, depending on technological evolution, regulatory landscapes, and competition from other digital assets. |

"The path is never linear," cautions BTCC financial analyst Mia. "Short-term volatility, as we see now, is inherent. The long-term thesis, however, rests on Bitcoin's immutable scarcity and its growing acceptance as a legitimate asset class. Each halving and adoption wave historically redefines its price floor and ceiling."